| Keeping Current Matters nails it with this graphic about pricing your house | ||

|

Sellers

Baby Boomers Are Moving

According to a Merrill Lynch study, “an estimated 4.2 million retirees moved into a new home last year alone.” Two-thirds of retirees say that they are likely to move at least once during retirement. As one participant in the study stated:

According to a Merrill Lynch study, “an estimated 4.2 million retirees moved into a new home last year alone.” Two-thirds of retirees say that they are likely to move at least once during retirement. As one participant in the study stated:

“In retirement, you have the chance to live anywhere you want. Or you can just stay where you are. There hasn’t been another time in life when we’ve had that kind of freedom.”

The top reason to relocate cited was “wanting to be closer to family” at 29%, a close second was “wanting to reduce home expenses” at 26%. A recent Freddie Mac studyfound similar results, as “nearly 20 percent of Boomers said they would move closer to their grandchildren/children compared to 13 percent who said they would move to a warmer climate.”

Not Every Baby Boomer Downsizes

There is a common misconception that as retirees find themselves with fewer children at home, they will instantly desire a smaller home to maintain. While that may be the case for half of those surveyed, the study found that three in ten decide to actually upsize to a larger home. Some choose to buy a home in a desirable destination with extra space for large family vacations, reunions, extended visits, or to allow other family members to move in with them. According to Merrill Lynch:

“Retirees often find their homes become places for family to come together and reconnect, particularly during holidays or summer vacations.”

Bottom Line

If your housing needs have changed or are about to change, meet with a local real estate professional in your area who can help with deciding your next step.

Another great article from Keeping Current Matters!

What’s Happening In the Real Estate Market

This is a pretty common question that a potential home buyer or seller may be asking themselves. Leading economists in real estate converged in New Orleans this past week as they presented their answer to this question at the 50th Annual Real Estate Journalism Conference for the National Association of Real Estate Editors.

Here are the top takeaways from the week of presentations:

Many of the conversations at the conference came back to the impact that Millennials and first-time home buyers will have on the market in the future. Jonathan Smoke, Chief Economist for realtor.com had this to say:

“At any given time in our history, demographics would explain 60-80% of what’s happening [in the market], and we are in a period of time where Millennials make up a largest demographic group according to the Census, at 84 million.”

According to the National Association of Realtors (NAR), the median first-time home buyer age is 30 and many millennials are entering a prime age to drive the housing market into the future.

Lawrence Yun, Chief Economist for NAR shared that myths and affordability may be holding back potential buyers:

“84% of current renters have the desire to own. While 36% believe they cannot afford a home and 60% of renters believe it would be ‘difficult’ to qualify for a mortgage.

Ellie Mae’s Vice President, Jonas Moe encouraged buyers to know their options before assuming that they do not qualify for a mortgage:

“Many potential home buyers are ‘disqualifying’ themselves. You don’t need a 750 FICO Score and a 20% down payment to buy.”

The National Multifamily Housing Council (NMHC) revealed that Millennials and Baby Boomers are often competing for the same housing inventory, causing a challenge as these two groups are the largest generations by population.

Both groups are looking for affordable, convenient homes close to city centers and ‘what’s happening.’

Bottom Line

The experts agree that homeownership is still desirable across all demographic groups, with Millennials and Baby Boomers having a great impact on available supply. If your dreams include owning your own home, meet with a local real estate professional who can evaluate your ability to buy now!

From Keeping Current in Real Estate

Today’s Real Estate Market

Sellers Happy, But Home Buyers Are Frustrated

The number of home buyers who say now is a good time to buy dipped to an all-time survey low in Fannie Mae’s latest Home Purchase Sentiment Index. Meanwhile, home owners who say now is a good time to sell soared to an all-time survey high.

The disconnect in the market is likely partially due to the limited number of homes for sale in many markets, allowing sellers to face less competition and ask for higher home prices. On the other hand, home buyers are having fewer choices and stuck paying higher prices, sometimes in multiple-bid situations.

Indeed, “we can partially attribute the sizable gain in April in home selling optimism both to a correction for last month’s unexpected dip and to typical seasonal strength in housing activity in the spring and summer,” says Doug Duncan, senior vice president and chief economist at Fannie Mae. “Even after accounting for these factors, continued tight housing supply has led to renewed strength in home price appreciation, making selling a home a more attractive prospect this year in particular. This improved sentiment could provide an extra boost of much-needed supply for the spring selling season.”

Some highlights from Fannie Mae’s latest Home Purchase Sentiment Index:

- 30% of Americans say now is a good time to purchase a home, a drop of 3 percentage points from the previous month and now at an all-time survey low.

- 15% of Americans say now is a good time to sell a home, now at an all-time survey high.

- More consumers think home prices will rise over the next 12 months compared to March, and slightly fewer consumers also expect mortgage rates to go up over the next year.

- The percentage of respondents who say they are not concerned with losing their job increased 6 percentage points to 74%, nearly a 7 percentage point decrease in March.

- The percentage of respondents who say their household income is significantly higher than it was 12 months ago held at 11%.

Source: Fannie Mae/Daily Real Estate News, NAR

If You Are Thinking of Selling, Now Is The Time

|

A great article from Keeping Current Matters

If you thought about selling your house this year, now may be the time to do it. The inventory of homes for sale is well below historic norms and buyer demand is skyrocketing. We were still in high school when we learned the concept of supply and demand: the best time to sell something is when supply of that item is low and demand for that item is high. That defines today’s real estate market. Jonathan Smoke, the Chief Economist of realtor.com, in a recent article revealed that:

Smoke goes on to say:

In this type of market, a seller may hold a major negotiating advantage when it comes to price and other aspects of the real estate transaction including the inspection, appraisal and financing contingencies. Bottom LineAs a potential seller, you are in the driver’s seat right now. It might be time to hit the gas |

Past, Present & Future Home Values

| From Keeping Current Matters

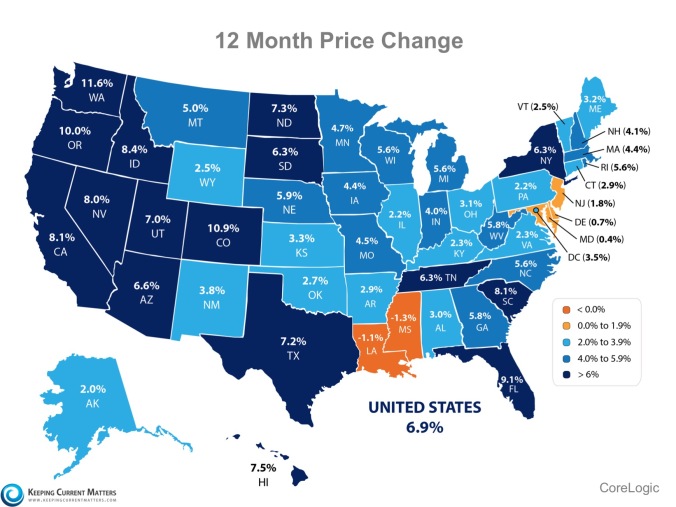

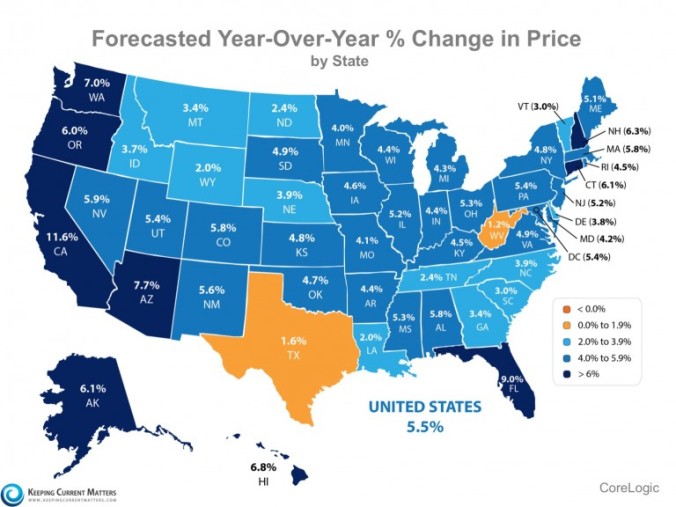

In CoreLogic’s latest Home Price Index, they revealed home appreciation in three categories: percentage appreciation over the last year, over the last month, and projected appreciation over the next twelve months. Here are state maps for each category:The Past – home appreciation over the last 12 months

|

Inventory Lacking In US Housing Market

Insightful article by Myles Udland, recently published in the Business Insider.

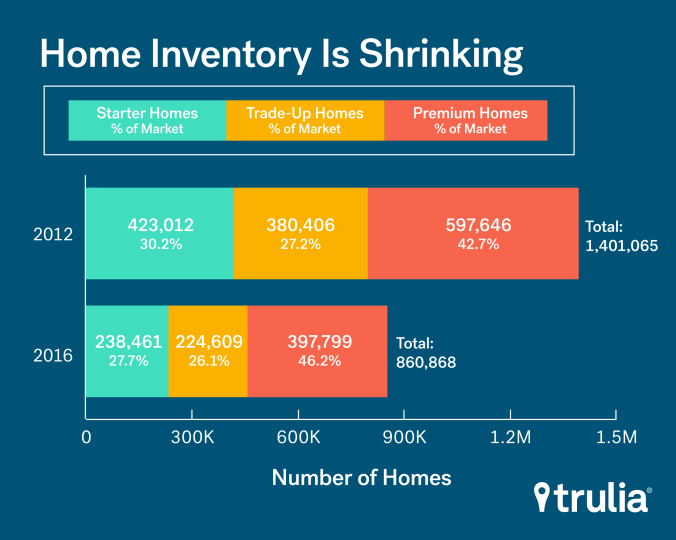

With inventories down and supply tight — as of February the outstanding stock of existing homes would only last 4.4 months at the current selling rate — the lowest price points in the market are being disproportionately affected, preventing millennials from buying homes and pushing up rent inflation.

In commentary published Monday, Ralph McLaughlin, chief economist at Trulia, noted that inventory for both starter homes and trade-up homes — the two lowest price brackets in the housing market — is down about 40% in the last four years.

Overall, the total number of homes sitting on the market is down to around 860,000, down from 1.4 million 2012.

In short, the US housing market is facing a severe lack of supply that will either be resolved by higher prices (and more inflation) or more building.

Home Prices On The Rise |

Low Inventory Causes Home Prices to Accelerate from: Keeping Current Matters The National Association of Realtors (NAR) released their latest Quarterly Metro Home Price report earlier this month. The report revealed that home prices are not only continuing to rise but that the increases are accelerating. Lawrence Yun, Chief Economist at NAR, discussed the impact of low inventory on buyers in the report: “Without a significant ramp-up in new home construction and more homeowners listing their homes for sale, buyers are likely to see little relief in the form of slowing price growth in the months ahead.” Here are the percentage increases of home prices for the last two quarters: What this means to sellersRising prices are a homeowner’s best friend. As reported by CoreLogic in a recent blog post: “With demand strong and inventory thin, the share of homes selling for the list price or more has also returned to pre-bust levels. With inventory tight, homes are more likely to sell above the asking price.” What this means to buyersIn a market where prices are rising, buyers should take into account the cost of waiting. Obviously, they will pay more for the same house later this year. However, as Construction Dive reported, the amounts of cash necessary to buy a home will also increase. “These factors have created a situation where the market keeps moving the goalposts in terms of the down payment necessary for first-time homebuyers to get into a home.” Bottom LineIf you’re thinking of selling and moving down, waiting might make sense. If you are a first time buyer or a seller thinking of moving up, waiting probably doesn’t make sense. |

Now, Not Spring, May Be The Time To Sell

Another great article from Keeping Current Matters!

It is common knowledge that a large number of homes sell during the spring-buying season. For that reason, many homeowners hold off on putting their home on the market until then. The question is whether or not that will be a good strategy this year. The other listings that do come out in the spring will represent increased competition to any seller. Do a greater number of homes actually come to the market in the spring, as compared to the rest of the year? The National Association of Realtors (NAR) recently revealed which months most people listed their home in for 2015. Here is a graphic showing the results:

It is common knowledge that a large number of homes sell during the spring-buying season. For that reason, many homeowners hold off on putting their home on the market until then. The question is whether or not that will be a good strategy this year. The other listings that do come out in the spring will represent increased competition to any seller. Do a greater number of homes actually come to the market in the spring, as compared to the rest of the year? The National Association of Realtors (NAR) recently revealed which months most people listed their home in for 2015. Here is a graphic showing the results: The three months in the second quarter of the year (represented in red) are consistently the most popular months for sellers to list their homes on the market. Last year, the number of homes available for sale in January was 1,860,000.

The three months in the second quarter of the year (represented in red) are consistently the most popular months for sellers to list their homes on the market. Last year, the number of homes available for sale in January was 1,860,000.

That number spiked to 2,280,000 by May!

What does this mean to you?

With the national job situation improving, and mortgage interest rates projected to rise later in the year, buyers are not waiting until the spring. They are out looking for a home right now. If you are looking to sell this year, waiting until the spring to list your home means you will have the greatest competition for a buyer.

Bottom Line

It may make sense to beat the rush of housing inventory that will enter the market in the spring and list your home today.

Top Six Reasons Why People Move